Bayfront Infrastructure Capital V

Bayfront Infrastructure Capital V Pte. Ltd. (“BIC V”) is Bayfront’s fifth public offering of Infrastructure Asset-Backed Securities (“IABS”) that priced in July 2024. BIC V issued 4 classes of rated Notes that are listed on the Singapore Exchange, an unlisted and unrated mezzanine Class D tranche that is guaranteed by GuarantCo Ltd, and an unrated equity tranche that is fully retained by Bayfront. BIC V offers investors exposure to a pre-assembled portfolio of project and infrastructure loans and bonds issued by borrowers in Asia Pacific, Middle East, the Americas and Africa.

Just like its predecessors BIC II, BIC III and BIC IV, the BIC V transaction once again featured a dedicated sustainability tranche, in the form of the Class A1-SU Notes, backed by eligible green and social assets as defined in Bayfront’s Sustainable Finance Framework. The Class A1-SU Notes have also been recognised by the Singapore Exchange for meeting recognised standards for green, social or sustainability fixed income securities.

Investor Relations

Offering Document

Moody’s Rating Reports

Issuance

Five Classes of Notes

The Class A1 Notes, Class A1-SU Notes, Class B Notes and Class C Notes are rated by Moody’s and listed on the Singapore Exchange. The Class D Notes are unlisted and unrated, and are guaranteed by GuarantCo Ltd (rated A1 by Moody’s as of July 2024 and AA- by Fitch as of May 2024).

The Preference Shares are solely retained by Bayfront as Sponsor of the transaction.

| Class | Amount Issued (US$ million) |

Amount Outstanding3 (US$ million) |

Issue Ratings (Moody’s) |

Spread4 | Legal Maturity Date | |

|---|---|---|---|---|---|---|

| Original | Current | |||||

| A1 | 208.7 | 208.7 | Aaa (sf) | Aaa (sf) | 140 bps | 11 April 2043 |

| A1-SU | 145.0 | 145.0 | Aaa (sf) | Aaa (sf) | 137.5 bps | 11 April 2043 |

| B | 76.8 | 76.8 | Aa1 (sf) | Aa1 (sf) | 180 bps | 11 April 2043 |

| C | 32.0 | 32.0 | A3 (sf) | A3 (sf) | 350 bps | 11 April 2043 |

| D1 | 20.3 | 20.3 | Not rated | Not rated | 275 bps | 11 April 2043 |

| Pref Shares2 | 25.5 | 25.5 | Not rated | Not rated | N.A. | |

1 The Class D notes are guaranteed by GuarantCo Ltd for principal and interest amounts payable

2 Retained and not offered

3 As of 18 July 2024

4 Spread is applied over 6-month Daily Non-Cumulative Compounded SOFR

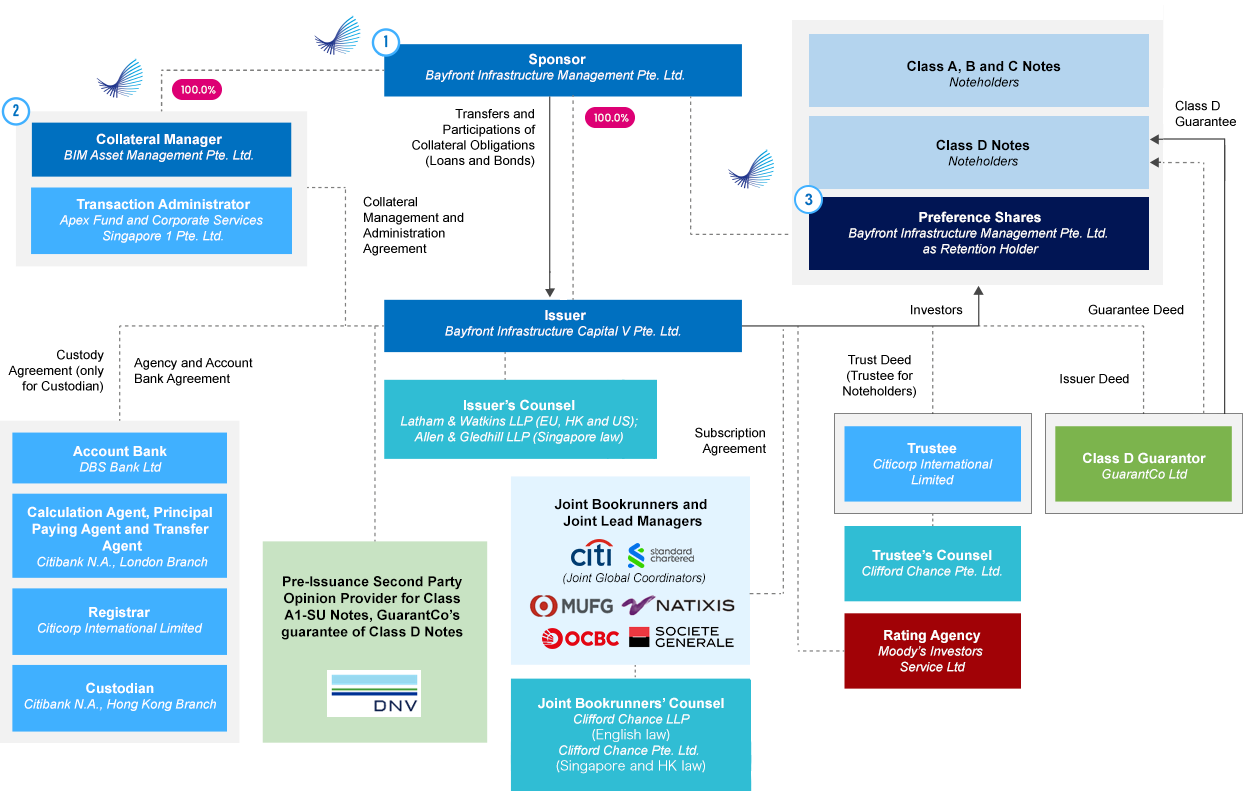

Key Transaction Parties

Bayfront is the Sponsor for BIC V.

As Sponsor, Bayfront was responsible for:

- sourcing of the Portfolio from the Originating Banks and executing loan/bond transfers, including initial screening, credit analysis, due diligence and documentation;

- liaising with credit rating agencies to obtain credit assessments on the portfolio assets and credit ratings for the Class A1, A1-SU, B and C notes (“Rated Notes”); and

- leading the structuring and execution of the transaction, including resourcing arrangements, investor marketing and distribution, together with the Joint Global Coordinators and Joint Bookrunners.

BIM Asset Management Pte. Ltd. (“BIMAM”) is the Collateral Manager for BIC V.

As Manager, BIMAM is providing certain investment management, administrative and advisory functions for BIC V which includes:

- managing and monitoring the performance of the portfolio assets;

- maintaining credit assessments on the portfolio assets and credit ratings of the Rated Notes;

- handling any replenishment and disposition of the portfolio assets (if required);

- handling all voting requirements, consents, amendments, modifications, waivers or any other notices for the portfolio assets;

- providing information available to the Transaction Administrator and ensuring that the Transaction Administrator operates the Priority of Payments and reporting requirements in a timely and accurate manner;

- providing management services including periodic investor reporting (in conjunction with the Transaction Administrator); and

- acting as primary interface with investors, banks, borrowers, multilateral financial institutions, export credit agencies and other stakeholders, including investor relations.

Apex Fund and Corporate Services Singapore 1 Pte. Limited is the Transaction Administrator for BIC V, performing portfolio administration and reporting services. Citicorp International Limited is acting as Trustee and DBS Bank Ltd. as the Account Bank.

The Issuer (BIC V) is a wholly owned subsidiary of the Sponsor (Bayfront). Bayfront holds all of the ordinary shares and also holds 100.0% of the preference shares.

Transaction Features and Highlights

- 37 project and infrastructure loans and bonds across 36 projects in Asia Pacific, Middle East, Africa and the Americas

- 15 countries of project and 10 industry sub-sectors that acts as mitigant to geographical, industry or business-cycle risks

- Focus on availability-based infrastructure and operational assets

- Larger pool of green and social assets and a decreasing proportion of oil & gas assets compared to prior BIC vehicles

- 92.9% of the portfolio at inception relates to operational projects, while the remaining 7.1% relates to projects in advanced stages of construction, but benefit from appropriate credit mitigants, such as sponsor completion guarantees or sponsor support

- 49% of the portfolio at inception are investment-grade assets, with a Moody’s Rating Factor of 610 (Baa3) or lower

- Stringent review and credit approval processes – (i) firstly by the originating banks and where applicable, any ECAs and MFIs providing credit support, (ii) secondly by our Credit Committee as part of our due diligence process during asset acquisition and (iii) thirdly by Moody’s when assigning ratings or credit estimates to each of the underlying portfolio assets

- Detailed analysis undertaken by credit rating agencies to assign credit estimates for each underlying loan (and public rating for the single project bond in the portfolio)

- Alignment of interests with Bayfront acting as the sponsor and full retention holder of first-loss equity tranche

- Experienced sponsor and manager with strong track record for infrastructure debt securitisations in Asia-Pacific, having closed five public issuances and one private placement to date

- Bayfront as Sponsor intends to retain the Preference Shares as risk retention holder through the life of the transaction

- Static pool with limited replenishment rights within a 3-year replenishment and 3-year non-call period

- Underlying assets supported by projects with stable and predictable long-term cash flows, including through offtake agreements with reputable and creditworthy counterparties

- The underlying asset debt service cash flows are predominantly USD denominated and floating rate, matching the cashflow profile of the Notes

- 74.5% of the portfolio involves project borrowers that need to maintain minimum debt service coverage ratios as one of their financial covenants

- 30.0% of the Notes issued are to be fully allocated to a portfolio of eligible green and social assets that meet the eligibility criteria stated in Bayfront’s Sustainable Finance Framework

- 37.6% of the portfolio at inception relates to green and social assets (renewable energy, energy efficient data centres, clean transportation, water desalination, education) that are tagged to the use of proceeds of this tranche, enhancing BIC V’s green footprint compared to the previous IABS transactions

Overview of the Portfolio

The Portfolio is diversified across 37 project finance and infrastructure and bonds, spread among 10 industry sub-sectors, and located in 15 countries across Asia Pacific, the Middle East, the Americas and Africa. The Portfolio is backed by 36 projects with stable and predictable long-term cash flows, including through offtake agreements entered with reputable and creditworthy counterparties including major global corporates, state-owned enterprises and government or government-linked sponsors.

The Portfolio has been assembled with a focus on availability-based infrastructure assets in the renewable energy and conventional power and water subsectors, while also including assets from other sub-sectors, subject to strong credit metrics and pre-set concentration limits put in place by Bayfront. Accordingly, Bayfront believes that the diversification within the Portfolio is a significant mitigant to geographical, industry or corporate and consumer business-cycle risks.

By Country of Project

Based on geographical project location

By Country of Risk

Based on ultimate source of payment risk

By Sector

By Credit Enhancement

By Ratings Distribution

By “Deep” Emerging Markets Exposure2

2 Defined as countries rated Ba3 and below by Moody’s.

By Commodity Price Exposure

Based on ultimate source of payment risk

ECA = Export Credit Agency

By Construction Risk

Based on ultimate source of payment risk

Portfolio Selection Principles

The following are the key selection principles that Bayfront has applied in selecting and constituting the Portfolio:

Structure and Sourcing

- Sourced from 15 leading international and regional commercial banks

- Focused on projects in Asia-Pacific, the Middle East, the Americas and Africa that are operational or in advanced stages of construction, but which benefit from appropriate credit mitigants, such as completion guarantees

- Certain loans are supported by export credit agencies, multilateral financial institutions and project sponsors through various forms of credit enhancement (e.g. guarantees and insurance)

- Focused on availability-based infrastructure assets

- High and moderate carbon intensity oil and gas sub-sectors (comprising LNG and gas, Floating production, storage and regasification, Other oil and gas, energy shipping) and metals and mining sub-sectors subject to concentration limits

Cashflows

- Primarily US$-denominated assets, reflecting the US$ payment profile for interest and principal on the Notes issued. Non-US$ assets will be FX hedged through cross-currency swaps until maturity of the relevant asset

- Predominantly floating rate for loan assets. Loan assets that bear fixed interest rates have been exchanged into floating rate exposures pursuant to interest rate swaps

- Fixed loan/ bond repayment schedules providing certainty on cash flows

Sustainability Tranche

Just like its predecessors BIC II, BIC III and BIC IV, the BIC V transaction also featured a dedicated sustainability tranche, in the form of the Class A1-SU Notes, backed by eligible green and social assets as defined in Bayfront’s Sustainable Finance Framework. The Class A1-SU Notes are considered Secured Sustainability Standard Bonds under ICMA Green Bond Principles 2021 (with June 2022 Appendix 1), Social Bond Principles 2023 and Sustainability Bond Guidelines 2021.

- 30.0% of the Notes issued are to be fully allocated to a portfolio of eligible green and social assets that meet the eligibility criteria stated in Bayfront’s Sustainable Finance Framework

- 37.6% of the portfolio at inception relates to eligible green assets (renewable energy, energy efficient data centres, clean transportation) and eligible social assets (water desalination, education), enhancing BIC V’s green footprint from the previous BIC II, BIC III and BIC IV transactions.

DNV Business Assurance Singapore Pte. Ltd. has provided a pre-issuance eligibility assessment on the Class A1-SU Notes.

Asset Pool by Original Loan Commitments

| Green Use of Proceeds | Asset Category | USD (mln) |

|---|---|---|

| Solar Energy Projects | Renewable Energy | 26.417 |

| Wind Energy Projects | Renewable Energy | 20.581 |

| Hybrid Renewable Energy Projects1 | Renewable Energy | 5.783 |

| Run-of-River Hydro Projects | Renewable Energy | 10.750 |

| Data Centre Projects | Energy Efficiency | 27.855 |

| Electric Vehicle Manufacturing Asset | Clean Transportation | 15.000 |

| Social Use of Proceeds | Asset Category | Social Benefit | Target Population | USD (mln) |

|---|---|---|---|---|

| Desalination Investments | Affordable Basic Infrastructure | Climate resilience – Drinking water supply | Residents of Oman, Qatar, Kuwait, Saudi Arabia and UAE | 59.726 |

| Educational Institution Investments | Access to Essential Services | Access to education | Women in UAE | 25.000 |

| Total | 191.112 |

1 Hybrid projects with a combination of solar and wind energy

Investor Profiles

By Investor Type

By Geography

Not for distribution to any person or address in the United States.

This website, and our social media sites, contain information which is for information purposes only. They do not constitute an offer nor an invitation nor a recommendation to subscribe to or to purchase, to hold or sell securities, nor is the information contained herein meant to be complete or to serve as a basis for any kind of obligation, contractual or otherwise. No representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, reliability, accuracy, completeness or correctness of such information. The information is not intended to provide and should not be relied upon for tax, legal or accounting advice, investment recommendations or a credit or other evaluation regarding the securities of Bayfront Infrastructure Capital V Pte. Ltd. or its affiliates (collectively, “Bayfront”). Additionally, third-party information distributed on our social media sites may not represent our views and unless otherwise expressly indicated, we take no responsibility for, nor do we endorse, any such information.

Any information memorandum posted up on this website is being provided as a historical, reference source only and is not being used, and no one is authorized to use, disseminate or distribute it, in connection with any offer, invitation or recommendation to sell or issue, or any solicitation of any offer to purchase or subscribe for, securities. The information memorandum is current only as at its date and such availability of the information memorandum on this website shall not create any implication that there has been no change in the affairs of Bayfront since the date of such information memorandum or that the information, statements or opinions contained therein is current as at any time subsequent to such date. Bayfront is under no obligation to update any information memorandum. An information memorandum may contain forward-looking statements and these statements, if included, must be read with caution as set forth in the section "Forward-looking statements" in such information memorandum.